christensen-1997

— Anthony GracaCitation #

@book{christensen2015innovator,

title={The innovator's dilemma: when new technologies cause great firms to fail},

author={Christensen, Clayton M},

year={1997},

publisher={Harvard Business Review Press}

}

Examples of Disruption #

- Blockbuster vs Netflix

- Stairs vs Elevators/Escalators

- Aircraft Autopilot + Human Pilots

- Cars and Self-Driving Cars

- automation. automated kitchens

Takeaways #

- Technology

- “means the processes by which an organization transforms labor, capital, materials, and information into products and services of greater value (Christensen 1997)”

apple is a UX company.

- Innovation

- refers to a change in one of these technologies

The book is built in two parts; - part one defines the framework that is the innovator’s dilemma - “good companies hitting hard times” is a meme. This means the company is a sinking ship - part two tries to solve it

Interesting Articles #

- wsj-where-does-the-best-innovation-happen-april-2024

- disruption is done wrong.

- “not first, but best”

- life philosophies

- keep moving forward - walt disney

- tomorrow is better than today - tim cook

- just do what is right

- apple vision pro is an early-adopter product

- https://www.wsj.com/business/crises-at-boeing-and-intel-are-a-national-emergency-093b6ee5?mod=wsjhp_columnists_pos_1

- https://www.wsj.com/articles/ge-powered-the-american-centurythen-it-burned-out-11544796010?mod=article_inline

- GE and Sears

- Intel

- https://www.wsj.com/tech/intel-microchip-competitors-challenges-562a42e3

- “only the paranoid survive”

Introduction #

- “This book is about the failure of companies to stay atop their industries when they confront certain market and technological change (Christensen 1997).”

- Specifically about good companies. Not just any company

- “The kind of companies that many managers have admired and tried to emulate, the companies known for their abilities to innovate and execute (Christensen 1997).”

- This isn’t about poorly managed companies. This is about well managed companies that still lose their market dominance

- “Sears Roebuck, for example, was regarded for decades as one of the most astutely managed retailers in the world. At its zenith Sears accounted for more than 2 percent of all retail sales in the United States (Christensen 1997)”

- Sears pioneered innovations that are critical to the success of companies today like supply chain management, store brands, catalogue retailing, and credit card sales

- but nobody talks that way about Sears today. They are now seen as the company of missed opportunities.

- This pattern of leadership failure has repeated many times in different industries

- Sears, IBM, Hewlett-Packard, Sun microsystems

- IBM dominated the mainframe market but lost out to minicomputers

- HP created minicomputers but missed the desktop personal computer market to Apple

- Xerox lost out to small photocopiers

- Blockbuster

- Missed out compared to Apple. Apple is particularly innovative because they focused on user-friendly computing.

- “One theme common to all of these failures, however, is that the decisions that led to failure were made when the leaders in question were widely regarded as among the best companies in the world (Christensen 1997).”

- “these failed firms were as well-run as one could expect a firm managed by mortals to be-but that there is something about the way decisions get made in successful organizations that sow the seeds of eventual failure (Christensen 1997).”

- “The research reported in this book supports this latter view: It shows that in the cases of well-managed firms such as those cited above, good management was the most powerful reason they failed to stay atop their industries. Precisely because these firms listened to their customers, invested aggressively in new technologies that would provide their customers more and better products of the sort they wanted, and because they carefully studied market trends and systematically allocated investment capital to innovations that promised the best returns, they lost their positions of leadership.”

- There are times when it is right not to listen to customers, invest in lower performance products, and pursue small markets.

- These are the Principles of Disruptive Innovation. Good companies fail when managers ignore these principles.

- “means the processes by which an organization transforms labor, capital, materials, and information into products and services of greater value”

- this means all firms have technologies.

- technology extends beyond engineering. It encompasses marketing and managerial processes.

- refers to a change in one of these technologies

- “Most new technologies foster improved product performance”

- “Innovations that result in worse product performance, at least in the near-term”

- “Products based on disruptive technologies are cheaper, simpler, smaller, and frequently, more convenient to use.”

Why Good Management Can Lead To Failure #

- Failure framework is made up of 3 parts

- There is a distinction between sustaining technologies and disruptive technologies

- this does NOT mean the naive view of incremental-versus-radical.

- “Sustaining technologies are technologies that foster improved product performance”

- Most technological advances in an industry are sustaining in character

- “Disruptive technologies bring to the market a very different value proposition than had been available.”

- they generally underperform the established products but provide other features that fringe and new customers value.

- “Products based on disruptive technologies are typically cheaper, simpler, smaller, more convenient to use”

- For example, small off-road motorcycles by Honda, Kawasaki, and Yamaha were disruptive compared to powerful, over-the-road cycles made by Harley-Davidson and BMW

- “In the near future, ‘internet appliances’ may become disruptive technologies to suppliers of personal computer hardware and software.

- The pace of technological progress usually outstrip what the markets demand and need.

- This is caused by competition. Companies try to provide a better product than their competitors by adding extra features to justify higher prices and higher profit margins. This means suppliers overshoot their market.

- I think of smartphone market right now as they are offering a bunch of random features.

- This means that disruptive technologies can easily catch up to what users actually demand for instead of catching up to the mainstream.

- Customers who needed mainframe computers for data processing realized they didn’t need to buy mainframes anymore when desktop machines were good enough.

- This means that the relevance of technological approaches changes with the market over time

- we really can’t use the same technology like a one trick pony forever. Change is inevitable

- Disruptive technologies tend to overshoot their market. They give customers more than they need. So this means they are a great value.

- This means disruptive technologies that underperform today may be competitive in the market tomorrow

- optimization of sustaining products overshoot what people need

- This is caused by competition. Companies try to provide a better product than their competitors by adding extra features to justify higher prices and higher profit margins. This means suppliers overshoot their market.

- Customers and investors heavily influence the kind of investment companies make. “the conclusion by established companies that investing aggressively in disruptive technologies is not a rational financial decision for them to make”

- thiel-2014

- “Disruptive products are simpler and cheaper; they generally promise lower margins, not greater profits”

- “disruptive technologies typically are first commercialized in emerging or insignificant markets”

- “most profitable customers generally don’t want and initially can’t use, products based on disruptive technologies.”

- companies that listen to customers are fucking over themselves.

- There is a distinction between sustaining technologies and disruptive technologies

Principles of Disruptive Technology #

Principle #1: Companies Depend on Customers and Investors for Resources #

- Customers and investors dictate how money will be spent. Managers don’t control how resources are used in their companies.

- Survival of the fittest here. Suboptimal allocation of resources to a project will eventually just die.

- Best performing companies have well-developed systems for killing ideas that their customers don’t want

- Google?

- this inherently means that companies will naturally find it difficult to invest in disruptive technologies, defined as lower-margin opportunities that their customers don’t want. These companies will feel like their best move is to kill those projects.

- When customers change their mind and suddenly want a disruptive product, the company is caught off guard.

- Managers survive by aligning themselves and their organizations with the forces of resource dependence

- Companies that are able to pull-off disruptive technologies must set up some autonomous organization specifically designed to build the new business around the disruptive technology.

- wsj-where-does-the-best-innovation-happen-april-2024

- Think skunk-works

- This is because there will be a short-term hit in profits and this autonomous org must not get killed.

- This forces an environment where the autonomous org is focusing on building a new and independent business around the disruptive technology.

- The new org can succeed with disruptive technologies when they surround themselves with people who want the products of the disruptive technology AND also is shielded from the customer/investor pressure of the mainstream company.

- This makes me think that silicon valley is unique because it has a ton of early adopters

- It is very difficult for a company tailored to compete to the high-end market to also be profitable in the low-end market as well.

Principle #2: Small Markets Don’t Solve the Growth Needs of Large Companies #

- Disruptive technologies enable new markets to emerge

- The first mover advantage applies to new markets

- But these small new markets aren’t worth it for big companies to come in.

- Hope that the market would get big but no guarantee.

- Big companies have a responsibility to grow their share price so they need to keep on growing.

- “A $40 million company needs to find just $8 million in revenues to grow at 20 percent in the subsequent year”

- “A $4 billion company needs to find $800 million in new sales”

- No new markets are that large.

- This all means that the bigger the company, the less interested they are in pursuing emerging markets.

- “Many large companies adopt a strategy of waiting until new markets are ’large enough to be interesting’”

- Chapter 6 will show us why this isn’t a successful strategy.

- “Many large companies adopt a strategy of waiting until new markets are ’large enough to be interesting’”

- Small companies are best suited for small markets

- more agile to respond to growth opportunities in the small market.

- ries-2011

Principle #3: Markets that Don’t Exist Can’t Be Analyzed #

- “Sound market research and good planning followed by execution according to plan are hallmarks of good management”

- Works best when applied to sustaining technologies because size and growth rates are known.

- Trajectories can be drawn.

- trajectories of technological progress have been established.

- Customer needs are well established and well articulated.

- “the vast majority of innovations are sustaining in character” so it makes sense for most executives to manage innovation in a sustaining context

- Does not apply to disruptive technologies

- Expert forecasts on emerging markets are usually wrong.

- For sustaining technologies, followers do just as well as leaders.

- For disruptive technologies, first mover advantage is paramount.

- This dynamic is the innovator’s dilemma

- Investors that demand for solid fundamentals get paralyzed or make serious mistakes when faced with disruptive technologies.

- they want market data that does not exist.

- projections can’t be made on financial revenues and costs

- either company loses out or they make bad investments to catch up.

- Chapter 7 will address this

Principle #4: An Organization’s Capabilities Define Its Disabilities #

- An organization’s capabilities reside in two places

- “An org’s processes :: the methods by which people have learned to transform inputs of labor, energy, materials, information, cash, and technology into outputs of higher value”

- The org’s values :: the criteria that managers and employees in the organization use when making prioritization decisions”

- People are flexible. They can change their work depending on the team’s need.

- But values and processes are not flexible.

- “A process that is effective at managing the design of a minicomputer would be ineffective at managing the design of a desktop personal computer”

- Or a process to build an internal combustion engine car vs an electric vehicle.

- “values that cause employees to prioritize projects to develop high-margin products, cannot simultaneously afford priority to low-margin products”

- “The very processes and values that constitute an organization’s capabilities in one context, define its disabilities in another context”

- Chapter 8 will address this. Will offer tools to create new capabilities.

Principle #5: Technology Supply May Not Equal Market Demand #

- chapter 9

- When two competing products are both so good that they fulfill every customer need, then customer choice is not based on the higher performing product.

- Choice is based on reliability, convenience, and price

- Companies chasing for the next higher performance products “creates a vacuum at lower price points into which competitors employing disruptive technologies can enter”

Part One: Why Great Companies Can Fail #

- Framework that describes why sound decisions by great managers can lead firms to failure.

- This describes the innovator’s dilemma: the logical, competent decisions of management that are critical to the success of their companies are also the reason why they lose their positions of leadership.

- The Hard Disk Drive industry is a great case study where changes in technology, market structure, global scope, and vertical integration have been incredibly rapid.

- What emerges are a set of simple and consistent factors that repeatedly determine the success and failure of the industry’s best firms.

- “This is one of the innovator’s dilemmas: Blindly following the maxim that good managers should keep close to their customers can sometimes be a fatal mistake.”

History of Disk Drives #

- First disk drive was invented in IBM in 1952.

- It was as big as a refrigerator and could store 5 MB of information

Chapter 1: How Can Great Firms Fail? Insights from the Hard Disk Drive Industry #

- The idea of good companies hitting hard times is a meme

- “This study of technological change over the history of the disk drive industry revealed two types of technology change, each with very different effects on the industry’s leaders. Technologies of the first sort sustained the industry’s rate of improvement in product performance (total capacity and recording density were the two most common measures) and ranged in difficulty from incremental to radical. The industry’s dominant firms always led in developing and adopting these technologies. By contrast, innovations of the second sort disrupted or redefined performance trajectories—and consistently resulted in the failure of the industry’s leading firms”

Sustaining Technological Changes #

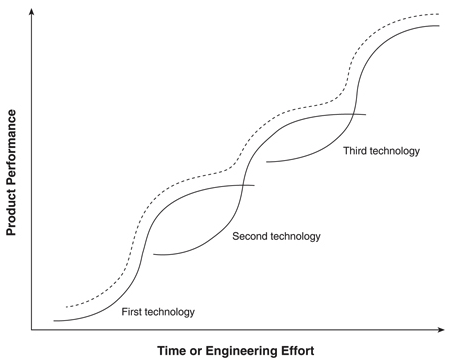

- Technology transitions is represented as a series of intersecting S-curves. foster-1986

- “Movement along a given S-curve is generally the result of incremental improvements within an existing technological approach, whereas jumping onto the next technology curve implies adopting a radically new technology”

- When technological progress levels off, as in the later portion of the S-curve, this suggests that we have a maturing technology

- “In literally every case of sustaining technology change in the disk drive industry, established firms led in development and commercialization”

- “The established firms were the leading innovators not just in developing risky, complex, and expensive component technologies such as thin-film heads and disks, but in literally every other one of the sustaining innovations in the industry’s history. Even in relatively simple innovations, such as RLL recording codes (which took the industry from double-to triple-density disks), established firms were the successful pioneers, and entrant firms were the technology followers. This was also true for those architectural innovations—for example, 14-inch and 2.5-inch Winchester drives— whose impact was to sustain established improvement trajectories. Established firms beat out the entrants.”

- “When faced with sustaining technology change that gave existing customers something more and better in what they wanted, the leading practitioners of the prior technology led the industry in the development and adoption of the new.”

- This means that boomer and/or established companies do not lose out because of the fast rate of technological change. Something else is causing established companies to fail.

Failure in the Race of Disruptive Technological Changes #

In reference to the above section, disruptive technologies topple industry leaders.

The disk drive is an example.

- Change in architecture from 14-inch diameter disks

- Change from 14 to 8-inches.

- Change from 8-inch to 5.25. One year after 8-inch drive was introduced.

- 8-inch drive was vastly superior for storage density.

- 5.25 didn’t cater to the needs to minicomputer manufacturers, the common customer of 8-inch drives.

- But 5.25 had features that appealed to the desktop personal computer. because of how small and lightweight they were.

- “Generally disruptive innovations were technologically straightforward, consisting of off-the-shelf components put together in a product architecture that was often simpler than prior approaches. They offered less of what customers in established markets wanted and so could rarely be initially employed there. They offered a different package of attributes valued only in emerging markets remote from, and unimportant to, the mainstream” - rosenbloom-christensen-1994

- Change from 5.25 to 3.5

- Change from 3.5 to 2.5 to 1.8

- Change in architecture from 14-inch diameter disks

In general, sustaining technologies correctly and aggressively optimize the supply chain to increase availability of the product.

- This inherently pushes down prices

- eventually pushes down demand as the market gets saturated. Also pushes down prices.

- In order to continue business growth, bringing new customers by tapping into a new market is necessary.

In 1974, the typical mainframe computer was configured with about 130MB per computer and that rate increased at 15% per year.

- Between 1978 and 1980, smaller 8-inch drives were introduced at 10-40MB capacity in contrast to mainframes with 300-400MB capacity.

- There was absolutely no demand for 8-inch drives for mainframe computer manufacturers because they just wanted more storage.

- 8-inch drives were sold to a new set of customers that did not manufacture mainframes, but made small, desk-side minicomputers.

- 14-inch disks were just too big and too expensive for desktop computers

- Customers were willing to pay for the premium of higher cost per megabyte in the new technology because the tech enabled customers to do something they weren’t able to before.

- This sounds like going from zero to one. thiel-2014

- Eventually so many new customers wanted minicomputers that it caused the 8-inch drive capacity to grow about 25% per year.

- Minicomputer customers learned how to use their machines and wanted to do more.

- 8-inch drive makers aggressively adopted sustaining innovations at this time, enabling them to increase capacity by more than 40% per year

- This growth eventually led to capacities that appealed to lower-end mainframe computers.

- The disruptive companies are now eating the lunch of established companies.

- This further fueled growth and increased capacity sizes until the 8-inch drives provided cost per megabyte that were much less than the 14-inch drive.

- 14-inch drives are now dead.

- “Within a three-to-four-year period, therefore, 8-inch drives began to invade the market above them, substituting for 14-inch drives in the lower-end mainframe computer market.

As the 8-inch products penetrated the mainframe market, the established manufacturers of 14-inch drives began to fail. Two-thirds of them never introduced an 8-inch model. The one-third that introduced 8-inch models did so about two years behind the 8-inch entrant manufacturers. Ultimately, every 14-inch drive maker was driven from the industry”

- Between 1978 and 1980, smaller 8-inch drives were introduced at 10-40MB capacity in contrast to mainframes with 300-400MB capacity.

This story is about how the 14-inch drive makers didn’t lose out because of technology.

- 8-inch products started out inferior by incorporating off-the-shelf components to start

- when the 14-inch drive makers set their sights to the 8-inch drive, new 8-inch drives developed by the boomer companies very performance-competitive with price per megabyte. But they weren’t better.

Held Captive by Their Customers #

- The reason why the 14-inch drive companies were so slow with developing their own 8-inch drives was not because of technology

- The boomer companies were technologically capable of producing competitive 8-inch drives.

- Boomer companies came in late because they strategically chose to not commit to an emerging market.

- “the established 14-inch drive manufacturers were held captive by customers. Mainframe computer manufacturers did not need an 8-inch drive. In fact, they explicitly did not want it: they wanted drives with increased capacity at a lower cost per megabyte. The 14-inch drive manufacturers were listening and responding to their established customers.”

- Listening to customers led to a wrong strategy

The Advent of the 5.25-inch Drive #

- History repeats with the 5.25-inch disk drive in the 1980.

- minicomputer manufacturers did not want a 5.25-inch drive with capacities of 5-10 MB when 40-60 MB was expected from 8-inch drives.

- Seagate entered the 5.25-inch disk market selling to desktop computers. Nobody was sure if normal people could afford desktop personal computers at the time..

- Once desktop PCs took hold, 5.25 disk capacity increased at about 25% per year. And then increased 50% per year for a decade.

- “On average, established firms lagged behind entrants by two years”

- Growth in 5.25-inch drives came in two waves:

- first enabled desktop computing.

- second was the substitution of 5.25 disks in minicomputer and mainframe markets.

The Pattern Is Repeated: The emergence of the 3.5-inch drive. #

There were ideas of a 3.5 inch drive in 1984.

- Former Seagate employees created a spinoff company called Connor Peripherals to develop the technology. They released a product in 1987

But Seagate was not oblivious to 3.5 inch drives this time and released a 3.5-inch drive in 1985, two years before Connor.

- However, there was managerial drama within Seagate. The 3.5-inch drive was pushed by engineers

- “Opposition to the program came primarily from the marketing organization and Seagate’s executive team; they argued that the market wanted higher capacity drives at a lower cost per megabyte and that 3.5-inch drives could never be built at a lower cost per megabyte than 5.25-inch drives.

Seagate’s marketers tested the 3.5-inch prototypes with customers in the desktop computing market it already served—manufacturers like IBM, and value-added resellers of full-sized desktop computer systems. Not surprisingly, they indicated little interest in the smaller drive. They were looking for capacities of 40 and 60 megabytes for their next-generation machines, while the 3.5-inch architecture could provide only 20 MB—and at higher costs.”

Again, listening to customers led a company astray.

- statistics and focus groups were used to kill the product

Seagate program managers lowered their 3.5-inch sales estimates and the firm’s executives cancelled the program.

- They thought 5.25-inch products had a larger market.

Seagate executives read the market very accurately. Their existing customers saw no value in the 3.5 drive.

“The fear of cannibalizing sales of existing products is often cited as a reason why established firms delay the introduction of new technologies. As the Seagate-Conner experience illustrates, however, if new technologies enable new market applications to emerge, the introduction of new technology may not be inherently cannibalistic. But when established firms wait until a new technology has become commercially mature in its new applications and launch their own version of the technology only in response to an attack on their home markets, the fear of cannibalization can become a self-fulfilling prophecy.”

Summary #

- There are several patterns in the history of innovation:

- Disruptive innovations are technologically straightforward

- They package known technologies into a unique architecture

- They enabled a new market access to the technology

- The purpose of advanced technology development was always to sustain established trajectories of performance improvement.

- New technologies are not supposed to be disruptive.

- Established firms are usually new entrants when adopting disruptive technologies.

- Disruptive innovations are technologically straightforward

- Established firms lose their ability to finding new applications and applying their products onto new markets because they are held captive by their customers

Chapter 2: Value Networks and the Impetus to Innovate #

- There are three prevailing theories why firms fail at confronting technology change

- Managerial, organizational, and cultural issues with responding to change

- Lack of focus to deal with radically new technology.

- New technology requires different skills than historically developed

- Author prefers the value network theory

Organizational and Managerial Explanations of Failure #

- “One explanation for why good companies fail points to organizational impediments as the source of the problem”

- Could be simple rationales like bureaucracy, complacency, or risk-averse culture.

- A study from henderson-clark-1990 “conclude that companies’ organizational structures typically facilitate component-level organizations” conways-law

- “Such systems work very well as long as the product’s fundamental architecture does not require change”

- This means that a firm does well when the fundamental product and product architecture does not change.

- “But when architectural technology change is required, this organizational system impedes innovations that require people and groups to communicate and work together in new ways”

- Organizations follow Conway’s law. Unveiling the product reveals the organizational structure of the company.

- This organizational structure would prevent the firm from creating radically new products.

- Does this mean that bigger companies can handle more complex products and problems?

Capabilities and Radical Technology as an Explanation #

- “Established firms tend to be good at improving what they have long been good at doing, and that entrant firms seem better suited for exploiting radically new technologies.”

- “Michael L. Tushman and Philip Anderson, “Technological Discontinuities and Organizational Environments, Administrative Science Quarterly, 1986”

- “They found that firms failed when a technological change destroyed the value of competencies previously cultivated and succeeded when new technologies enhanced them”

- Christensen doesn’t believe in this theory because the disk drive industry serves as a counter example

- There are existing firms that can introduce architectural and component innovations that would serve their prior competencies irrelevant.

- Makes me think of Norway transitioning away from oil to renewables

- Also thinks that existing companies stumble over technologically straightforward but distruptive changes like the 8-inch drive.

- There are existing firms that can introduce architectural and component innovations that would serve their prior competencies irrelevant.

- Christensen really believes that the customer is what holds companies back

- “if their customers needed an innovation, the leading firms somehow mustered the resources and wherewithal to develop and adopt it. Conversely, if their customers did not want or need an innovation, these firms found it impossible to commercialize even technologically simple innovations”

Value Networks and New Perspective on the Drivers of Failure #

- “A value network

- is the context within which a firm identifies and responds to customers’ needs, solves problems, procures input, reacts to competitors, and strives for profit”

- a value network is determined by a specific rank-ordering of product attributes valued by customers, and it is also characterized by a specific cost structure required to provide the valued products and services"

- “The value network defines the customers’ problems to be addressed by the firm’s products and service and how much can be paid for solving them”

Perception of value changes dependent on a firm’s competitive strategy for profit. - This means established firms really focus all of their efforts on expected rewards through market research. - Established firms naturally prioritize all of their resources toward sustaining innovations. - This opportunity cost means they can’t invest in disruptive technologies.

Value Networks Mirror Product Architecture #

- Companies structure their products as nested components which lead to another product. Russian doll style

- supercharges conway’s law to apply outside of company.

- lakos-2020 seems to agree with this.

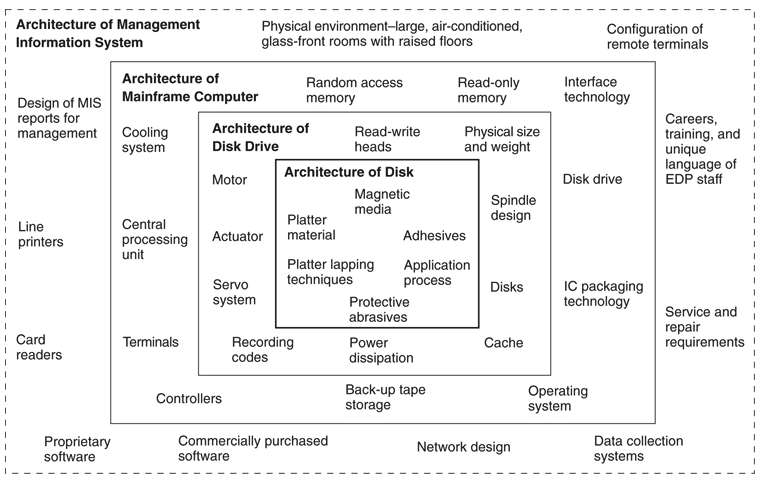

- a management information system architecture contains several components:

- a mainframe computer

- peripherals like printers and disk drives

- software

- etc.

- The next level is the mainframe computer which itself is an architected system.

- Contains a CPU, RAM, disk drives, etc

- telescoping down, a disk drive is also an architecture

- contains a motor, actuator, spindle, disks, etc.

- All these components and goods could be produced top-to-bottom by one mega corporation, like AT&T or IBM (or more modern, apple), but other than those companies they are usually traded.

- This means “the nested physical architecture of a product system also implies the existence of a nested network of producers and markets through which the components at each level are made and sold to integrators at the next higher level in the system”

- This entire nested commercial system is a value network

Figure 1: A Nested, or Telescoping, System of Product Archiectures

Metrics of Value #

- Different markets have different definitions of value. This means value for a product differs across value networks

- Mainframes put a ton of value on cost per MB but none in portability of disks

- Desktop PCs put a lot of value on cost per MB but also a ton of value in portability of disks

Figure 2: Examples of Three Value Networks

- “Although many components in different systems-of-use may carry the same labels, the nature of the components used may be quite different”

- for example, each network involve disk drives, printers, software, etc

- Generally, a set of competing firms, each with their own embedded value chain and value network is associated with each box in figure 2-2.

- This means firms supplying the products and services used in each network differ

- “As firms gain experience within a given network, they develop capabilities, organizational structures, and cultures tailored to their value network’s distinctive requirements”

- Also applies to manufacturing, production, product development cycle times, and organizational consensus specifically catered to identifying customer and customer needs.

- These customer and customer needs differ substantially from one value network to the next

- hedonic regression analysis is used to determine the total price of a product as a sum of the individual shadow prices.

- different value networks place very different values on a given attribute

- “customers in the mainframe computer value network in 1988 are willing to pay on average $1.65 for an incremental megabyte in capacity”

- “but moving across the minicomputer, desktop, and portable computing value networks, the shadow price of an incremental megabyte of capacity declines to $1.50, $1.45, and $1.17 respectively”

- “Conversely, portable and desktop computing customers were willing to pay a high price in 1988 for a cubic inch of size reduction, while customers in the other networks placed no value on that attribute at all

- “customers in the mainframe computer value network in 1988 are willing to pay on average $1.65 for an incremental megabyte in capacity”

Cost Structures and Value Networks #

- “The definition of a value network goes beyond the attributes of the physical product.”

- Includes substantial research, engineering, and development costs

- This means manufacturing overhead is high due to low unit volume and customized product configurations

- “Selling directly to end users involves significant sales force costs”

- Also include field support representatives to support customers

- “For these reasons, makers of mainframe computers, and makers of the 14-inch disk drives sold to them, historically needed gross profit margins of between 50 percent and 60 percent to cover the overhead cost structure inherent to the value network in which they competed.”

- Different value networks have different cost structures.

- Compare with the portable computer value network. They “can be profitable with gross margins of 15 percent to 20 percent”

- “These computer makers incur little expense researching component technologies, preferring to build their machines with proven component technologies procured from vendors”

- “Manufacturing involves assembling millions of standard products in low-labor-cost regions.”

- “most sales are made through national retail chains or by mail order”

- a value network is determined by a specific rank-ordering of product attributes valued by customers, it is also characterized by a specific cost structure required to provide the valued products and services”

- “The cost structures characteristic of each value network can have a powerful effect on the sorts of innovations firms deem profitable”

- “innovations that are valued within a firm’s value network will be perceived as profitable”

- because of the 50-60% profit margin

- innovations and technologies that are valuable in networks with lower gross margins are not seen as profitable and will not attract resources or managerial interest

- Author believes that the strength of established firms in sustaining innovation and their weakness in disruptive innovation. And the opposite strengths and weaknesses of entrant firms are a consequences of their value networks and not because of technological or organizational capabilities.

Technology S-Curves and Value Networks #

- “The technology S-curve forms the centerpiece of thinking about technology strategy”

- This means that “the magnitude of a product’s performance improvement in a given time period or due to a given amount of engineering effort is likely to differ as technologies mature”

- Rate of progress is slow for the early stages of technology

- As the technology becomes better understood, the rate of technological improvement will accelerate

- In the mature stages, the technology will asymptotically approach a natural or physical limit.

- Law of diminishing returns. The engineering effort is just not worth it anymore.

- Figure 2.5 shows this.

- The dotted line in figure 2.5 shows the desire of strategic technology management to identify and develop whatever successor technology would eventually supplant the present approach

- This is also a challenge with timing. The goal is to switch to a new curve where the old curve intersects.

- Not identifying the new technologies threatening from below and switching to them in a timely manner could be a cause of failure of established firms

Figure 3: The Conventional Technology S-Curve

How do S-Curves and Value Networks relate to each other? #

- figure 2.5 actually shows how sustaining technology changes within a value network.

- The vertical axis shows product performance for a single value network.

- This looks similar to the disk drive industry.

- This shows that “there was not a single example in the history of technological innovation in the disk drive industry of an entrant firm leading the industry or securing a viable market position with a sustaining innovation”

- established companies that “anticipated the eventual flattening of the current technology and that led in identifying, developing, and implementing the new technology that sustained the overall pace of progress were the leading practitioners of the prior technology”

- These established “firms often incurred enormous financial risks, committing to new technologies a decade or more in advance and wiping out substantial bases of assets and skills”

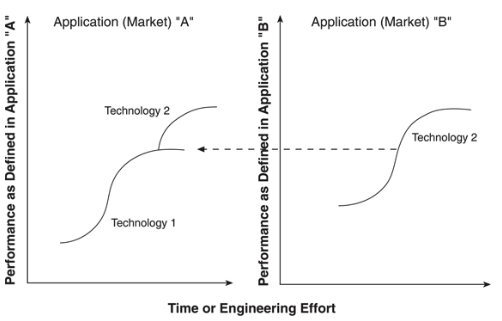

- However a disruptive innovation, by definition, could not be plotted in a figure like 2.5. This is because the vertical axis for performance measure different attributes apart from an established value network.

- Figure 2.6 is actually more accurate to describe disruptive technologies.

- “Disruptive technologies emerge and progress on their own, uniquely defined trajectories, in a home value network”

- “If and when they progress to the point that they can satisfy the level and nature of performance demanded in another value network, the disruptive technology can then invade it, knocking out the established technology and its established practitioners, with stunning speed”

- This is the innovator’s dilemma

- Established companies can work as hard as they want: increased R&D, longer investment, technology scanning & forecasting & mapping, as well as fund research and joint ventures.

- But all that effort falls along figure 2.5 for sustaining technologies

- None of these solutions addresses the figure 2.6 situation where firms get blindsided by a fundamentally different nature

Figure 4: Disruptive Technology S-Curve

Managerial Decision Making and Disruptive Technological Change #

- “The value network defines the customers’ problems to be addressed by the firm’s products and service and how much can be paid for solving them”

- “Competition and customer demands in this value network shape the firms’ cost structure, the firm size required to remain competitive, and the necessary rate of growth”

- Thus, managerial decisions that make sense for companies outside a value network may make no sense at all for those within it, and vice versa"

- “Good managers do what makes sense, and what makes sense is primarily shaped by their value network”

Decision-making pattern #

- 6 steps emerged from interviews with more than 80 managers in the disk drive industry. Both encumbents and entrants

- established companies did not have trouble with developing the technology.

- prototypes have been built before the management had to make the decision

- but disruptive projects stalled because it would be taking away scarce resources on a competing product

- sustaining projects were prioritized by the firms’ most powerful customers over disruptive technologies with small markets & poorly defined customer needs.

Step 1: Disruptive Technologies Were First Developed within Established firms #

- “although entrants led in commercializing disruptive technologies, their development was often the work of engineers at established firms, using bootlegged resources.”

- “these architecturally innovative designs almost always employed off-the-shelf components.

- “Engineers at Seagate Technology, the leading 5.25-inch drive maker, were, in 1985, the second in the industry to develop working prototypes of the 3.5-inch models. They made some eighty prototype models before the issue of formal project approval was raised with senior management”

Step 2: Marketing Personnel Then Sought Reactions from Their Lead Customers #

- engineers showed their prototypes to marketing

- marketing does their job by testing the market appeal for new drives

- not surprisingly, IBM showed no interest in Seagate’s 3.5-inch drives.

- IBM was looking for 40-60MB drives and they already had a slot for 5.25-inch drives

- marketers come back with pessimistic sales forecasts

- Disruptive technologies were lower performance so they had lower profit margins.

- financial analysts join in and oppose the disruptive program

- The 3.5-inch drive project gets shelved even though it is becoming firmly established in the laptop market

- This is a question of opportunity cost and marketers felt it was more critical to remain competitive with current customers with higher profit targets.

- Management made the explicit decision not to pursue the disruptive technology.

- Managers, engineers, and marketers were all acting in the best interest in the company.

- But unconsciously starved the disruptive project of resources necessary for a timely launch

- Engineers get pulled off of the disruptive product to work on problems with the flagship product

Step 3: Established Firms Step Up the Pace of Sustaining Technological Development #

- Decision has been made to focus more on the sustaining product.

- This seemed reasonable to give the customer what they wanted because the focus was on high margin profits and large markets

- We are already seeing greater development costs because we are at the later end of the S-curve but this is seen as far less risky than investing in disruptive technology

- “Seagate’s decision to shelve the 3.5-inch drive in 1985 to 1986, for example, seems starkly rational. Its view downmarket (in terms of the disk drive trajectory map) was toward a small total market forecast for 1987 for 3.5-inch drives. Gross margins in that market were uncertain, but manufacturing executives predicted that costs per megabyte for 3.5-inch drives would be much higher than for 5.25-inch drives. Seagate’s view upmarket was quite different. Volumes in 5.25-inch drives with capacities of 60 to 100 MB were forecast to be $500 million by 1987. Companies serving the 60 to 100 MB market were earning gross margins of between 35 and 40 percent, whereas Seagate’s margins in its high-volume 20 MB drives were between 25 and 30 percent. It simply did not make sense for Seagate to put its resources behind the 3.5-inch drive when competing proposals to move upmarket by developing its ST251 line of drives were also being actively evaluated.”

- Seagate produced new 5.25-inch models at a dramatically accelerated rate.

- This was motivated because of trying to beat out competitors

- Completely blind to entrants from below

Step 4: New Companies Were Formed, and Markets for the Disruptive Technologies Were Found by Trial and Error #

- frustrated engineers from established firms defected to form their own companies

- Connor Peripherals, leader in the 3.5-inch drive, was started by disaffected employees from Seagate and Miniscribe, the two largest 5.25-inch manufacturers.

- The startups had to find new customers. Very uncertain

- the personal computers at the time were just simple toys for hobbyists

- “The founders of these firms sold their products without a clear marketing strategy-essentially selling to whoever would buy”

- “largely a trial-and-error approach to the market, the ultimately dominant applications for the products emerged”

Step 5: The Entrants Moved Upmarket #

- Once the startups have a foothold on a new market, they “adopted sustaining improvements in new component technologies”

- This is what thiel-2014 meant by becoming a monopoly

- performance increases at a faster rate. up to 50%

- These high performance increases enable startups to eye established companies

- New wave of customers begin to accept and embrace the new disruptive architecture because performance metrics were finally being met

Step 6: Established Firms Belatedly Jumped on the Bandwagon to Defend Their Customer Base #

- When the smaller drive models began to invade established market segments, the established firms took their prototypes off the shelf and tried to defend their customer base in their own market.

- But by this time, the disruptive architecture is performance competitive with the larger drives

- “The entrant firms had developed insurmountable advantages in manufacturing cost and design experience” which eventually led established firms to withdraw

- The entrant firms were used to 20% profit margins so they could price their products competitively

- The defending, established firms were experiencing a severe price war

- Established firms that did succeed in introducing the new architectures were just surviving.

- They never won a significant share of the new market

- New drives simply cannibalized older products for existing customers

- Moral of the story, listening to your customers is misleading in instances of disruptive technology change

Flash Memory and the Value Network #

- this is the author trying to predict flash memory as a disruptive technology at the time.

- Flash differs from DRAM.

- Flash retains memory even when the power is off. This means flash uses 5% of the energy of a disk drive

- No moving parts means flash is more rugged

- But flash is expensive. 5-50x more expensive than disk

- Flash isn’t robust for writing. It could only be written a few hundred thousand times. Disks can be written a few million times.

- Flash memory value networks are distant from computing.

- They are in cell phones, heart monitoring devices, modems, and industrial robots.

- Disk drives were too big, too fragile, and consumed too much power

- Will flash invade disk drives?

- In 2023, they do.

- Disk drives still exist but most people don’t need that much memory. they would prefer a cleaner look.

- it also doesn’t make sense to buy a smaller capacity disk drive.

The Capabilities Viewpoint #

- Although the electronics technology for flash memory is radically different from the magnetics and mechanics of disk drives, this isn’t the gap that established companies worry about

- Rather, established firms like seagate and western digital have “developed deep expertise in custom integrated circuit design through embedding increasingly intelligent control circuity and cache memory in their drives.”

- “flash memory actually builds upon the important competencies that many drive makers have developed”

- “Each of today’s leading disk drive manufacturers got its start by designing drives, procuring components from independent suppliers, assembling them either in its own factories or by contract, and then selling them. The flash card business is very similar.”

- not just technology. consider process and organization

- “Seagate and Western Digital will bring flash products to market quite readily.”

- In contrast, “others which historically outsourced much of their electronic circuit design, may face more of a struggle”

The Technology S-Curve Framework #

- “The technology S-curve is often used to predict whether an emerging technology is likely to supplant an established one. The operative trigger is the slope of the curve of the established technology. If the curve has passed its point of inflection, so that its second derivative is negative (the technology is improving at a decreasing rate), then a new technology may emerge to supplant the established one. ”

- “The S-curve framework would lead us to predict, therefore, that whether or not established disk drive companies possess the capability to design flash cards, flash memory will not pose a threat to them until the magnetic memory S-curve has passed its point of inflection and the rate of improvement in density begins to decline.”

Insights from the Value Network Framework #

- Christensen asserts that none of the previous frameworks are sufficient predictors

- If an established firm did not possess the technological skills to develop a new technology, they would just acquire their competition if their customers demanded it

- Technology S-Curves only make sense for predicting sustaining technologies

- The trajectories of disruptive technologies do not initially intersect with established ones.

- The value network framework says that it’s not a technological problem for seagate and western digital to develop competitive flash memory products,

- but whether they have the resources and managerial energy to determine whether flash memory has value within the firm’s value networks.

- compare historically, flash memory is rugged and consume little power but didn’t have the capacity needed in 1996.

- Cost for comparable storage to disk would be 50x higher at the time.

- “The low power consumption and ruggedness of flash have no value and command no price premium on the desktop”

- So that means there was no way to use flash in markets where seagate and western digital make their money

- So flash memory were being used in markets different than what seagate and western digital engage in: palmtop computers, electronic clipboards, cash registers, electronic cameras, and so on.

- value network framework predicts that seagate and western digital would not build market-leading positions in flash memory

- “not because the technology is too difficult or their organizational structures impede in development, but because their resources would be absorbed in fighting for and defending larger chunks of business in the mainstream disk drive value networks in which they currently make their money”

- “Indeed, the marketing director for a leading flash card producer observed, “We’re finding that as hard disk drive manufacturers move up to the gigabyte range, they are unable to be cost competitive at the lower capacities. As a result, disk drive makers are pulling out of markets in the 10 to 40 megabyte range and creating a vacuum into which flash can move.”

- this is how samsung and sandisk got started with flash cards

- This is why seagate and western digital haven’t built even 1 percent market share of the flash card market

Implications of the Value Network Framework for Innovation #

- “Value networks strongly define and delimit what companies within them can and cannot do”

- This chapter reveals 5 propositions about the nature of technological change and the problems incumbent firms encounter:

- “The value network in which a firm competes has a profound influence on its ability to marshal and focus the necessary resources and capabilities to overcome the technological and organizational hurdles that impede innovation.”

- ?

- u

Chapter 3: Disruptive Technological Change in the Mechanical Excavator Industry #

- innovator’s dilemma is not just a tech industry problem.

The Impact of Disruptive Hydraulics Technology #

- In the 1960s, the dominant source of power was the diesel engine for extending and lifting buckets

- but hydraulics were coming to replace the cable-actuated systems

- Only 4 companies in a group of 30 cable-actuated systems in 1950 survived to transition to hydraulics by the 1970s

- The firms that overran the excavation equipment were new companies

- John Deere, Ford, Caterpillar, Hitachi, etc.

- But why?

Performance Demanded in the Mechanical Excavator Market #

- There are many types of earth moving equipment

- bulldozers, loaders, graders, and scrapers essentially push, smooth, and lift earth

- Excavators are used to dig holes and trenches and they serve 3 markets

- general excavation market composed of contractors who dig holes for basements or civil engineering projects

- sewer and piping contractors who dig long trenches

- open pit or strip mining.

- Performance of excavators is measured by their reach and how many cubic yards of earth lifted in a single scoop

- in 1945, sewer and piping contractors used machines whose bucket sizes averaged 1 cubic yard, which is great for narrow trenches

- average excavation contractor used excavators that lifted 2.5 cubic yards per scoop

- mining contractors used shovels holding 5 cubic yards.

- Average bucket capacity increased at 4% per year.

The Emergence and Trajectory of Improvement of Hydraulic Excavation #

- The first hydraulic excavator was developed by a british company, J. C. Bramford, in 1947

- similar products also emerged in american companies during the 1940s

- These machines were mounted on the back of farm tractors

- limited by the strength of the available hydraulic pumps’ seals, the capacity was just only 0.25 cubic yards

- Their reach was also only 6 feet.

- The best cable excavators could rotate full 360 degrees while the backhoes could only rotate 180 degrees

- Because of short reach and low capacity, hydraulics were not used in mining, general excavation, or sewer contractors because they wanted buckets that held 1 to 4 cubic yards.

- The entrant firms had to develop their own new markets with new applications

- the new market consisted in selling the hydraulic backhoes as attachments to tractors. This enabled small residential contractors to dig narrow ditches at the foundations of homes for water and sewer

- jobs were too small to bring in a big, imprecise, cable-actuated, track-driven shovel so these trenches were usually dug by hand

- Hydraulic backhoes attached to highly mobile tractors can do the job in a little less than an hour

- They became super popular with contractors building out homes during the housing boom following WWII and the Korean War

- “The early users of hydraulic excavators were very different from the main stream customers of the cable shovel manufacturers - in size, in needs, and in the distribution channels through which they bought. This consisted a new value network for mechanical excavation”

- just like in the disk drive industry, the performance of smaller-architecture disk drives were measured with difference performance metrics than the performance of large drives by prioritizing weight, ruggedness, and power consumption over capacity and speed

- backhoes were measured differently than cable-actuated equipment

- people valued shovel width with backhoes to dig narrow, shallow trenches and they also valued the speed and maneuverability of the tractor.

- big earthmoving projects didn’t care about speed and maneuverability

- The new hydraulic architecture enabled growth to lift 10 cubic yards by 1974

- this higher rate of improvement enabled hydraulics to enter the original market of large, mainstream excavation.

- This application of hydraulics for general contracting enabled them to gain track-mounted models which means they could rotate at its base a full 360-degrees.

- What is done by hand that we can automate? create a new value network for new set of customers

The Response to Hydraulics By The Established Excavator Manufacturers #

- Just like how Seagate was one of the first firms to develop the prototype 3.5-inch drives, the leading cable shovel maker, Bucyrus Erie, was keenly aware of hydraulic excavating technology

- Buchrus bought a struggling hydraulic backhoe company

- Bucyrus faced the same problem in marketing the hydraulic backhoe to the original mainstream customers like seagate did. They just wanted bigger capacity and no use for the mobility

- Tried to make modification that used both hydraulics and cable but was really set in marketing the product based on capacity, based on the existing customer needs

- Did not try to pursue the disruptive new value network

- Did not sell well due to limited capacity and reach compared to competitor cable-actuated systems

- But companies selling cable-actuated shovels were doing quite well and were making record profit until 1966

- This was the point where disruptive hydraulics technology intersected with customer needs in the sewer and piping segment.

- This is typical. Leading firms with established technologies continue to be financially strong until the disruptive technology enters the mainstream market

- established cable shovel manufacturers tried to offer their own hydraulic offerings to their existing customers

- But the strategy differs with successful entrants which accepted the capabilities of the hydraulics technology in the 1940s and 1950s and tried to cultivate a new market application with the technology. This creates value

The Choice Between Cable and Hydraulics #

- The moment hydraulics satisfied the requirements of mainstream excavation contractors, cable became irrelevant

- cable is still capable of farther reach and greater lift than hydraulics but it wasn’t necessary

- hydraulics was good enough.

- However contractors preferred hydraulics because it was less prone to breakdowns than cable-actuated excavators.

- cable snap during a heavy lift was life threatening so transition hydraulics happened quickly the moment it was good enough.

Consequences and Implications of the Hydraulics Eruption #

- “What went wrong with companies that made cable-actuated excavators? Clearly, with the benefit of hindsight, they should have invested in hydraulics machines and embedded that piece of their organizations charged with making hydraulic products in the value network that needed them (Christensen 1997, 73).”

- However the dilemma is that nothing went wrong with the companies that made cable-actuated excavators

- their customers couldn’t use hydraulics at the time

- the cable-actuated excavator manufacturers were focused on competing with other cable-actuated excavator manufacturers.

- So it made more sense and was more profitable to just make bigger, better, and faster cable excavators to steal share from existing competitors than to join the smaller hydraulic backhoe market.

- “So, as we have seen before, these companies did not fail because the technology wasn’t available. They did not fail because they lacked information about hydraulics or how to use it; indeed, the best of them used it as soon as it could help their customers. They did not fail because management was sleepy or arrogant. They failed because hydraulics didn’t make sense-until it was too late (Christensen 1997, 73).”

- “The patterns of success and failure we see among firms faced with sustaining and disruptive technology change are a natural or systematic result of good managerial decisions. That is, in fact, why disruptive technologies confront innovators with such a dilemma. Working harder, being smarter, investing more aggressively, and listening more astutely to customers are all solutions to the problems posed by new sustaining technologies. But these paradigms of sound management are useless-even counterproductive, in many instances-when dealing with disruptive technology (Christensen 1997, 73).”

Chapter 4: What goes Up, Can’t Go Down #

Part Two: Managing Disruptive Technological Change #

- This part seeks to resolve the dilemma and describes solutions

Chapter 5: Give Responsibility for Disruptive Technologies to Organizations Whose Customers Need Them #

Chapter 6: Match the Size of the Organization to the Size of the Market #

Chapter 7: Discovering New and Emerging Markets #

Chapter 8: How to Appraise Your Organization’s Capabilities and Disabilities #

Chapter 9: Performance Provided, Market Demand, and the Product Life Cycle #

Chapter 10: Managing Disruptive Technological Change: A Case Study #

- this talks about electric vehicles

Chapter 11: The Dilemmas of Innovation: A Summary #

- transfer capital

- transfer crossing the chasm

- transfer blitzscaling